China Market Commentary: November 2022

Here are this month’s highlights: The recent Covid-related protests in multiple cities suggest that volatility will persist in the near term. China has more STEM graduates than India, the US, Russia, Iran, Indonesia and Japan combined. It is perhaps no surprise that China has the most unicorns (start-ups that are worth more than USD1bn) in the world after the US.

The road to Disneyland for China

In October, Chinese equities tumbled close to historically low valuations as headline news continued to weigh on sentiment. These included additional restrictions on chip exports to China by the US government, increasingly strict pandemic controls ahead of the Party Congress and a new leadership line-up consisting entirely of President Xi Jinping’s loyalists. A fire sale of overseas-listed Chinese shares by foreign investors sent the MSCI China Index down 16.8% for the month, while locally listed China A Shares were more resilient, with the MSCI China A Onshore Index down 8.2%. We shared in our last letter that foreign investors may have had unrealistic expectations on the outcome of the Party Congress, while our China managers’ assessment was more neutral. At the time of writing, markets have since reversed rapidly and have recovered the entire October drawdown.

On the macro side, as widely expected, recent economic indicators point to a slowdown in recovery. Both manufacturing and services Purchasing Managers’ Index (PMI) contracted in October, and travel volume fell significantly during the National Day holiday compared to a year ago due to Covid controls. However, we expect economic growth to stabilise and accelerate in the coming quarters with the support of policy stimulus. In recent weeks, we have seen positive policy signals on multiple fronts, from easing pandemic controls to injecting liquidity in the property sector and pausing regulation of big tech companies.

The bumpy road to Disneyland

At a recent conference, Mohamed El Erian, Chairman of Gramercy and previously CEO of PIMCO, referred to the future for investors globally as the “bumpy road to Disneyland”. He described the experience of a father and son who leave for Disneyland excited but arrive all tired and exhausted after going through traffic, detours and travel sickness. By the time they arrive at their destination, the excitement of going to Disneyland has been totally beaten out of them.

The story resonates with those who have invested in China over the last two years. We have commented at length on the bumps on the road – whether they are regulation, geopolitics or Covid lockdowns. Some recent positive news did send the MSCI China Index up more than 20% month to date in November; however, more traffic jams may yet be around the corner. The recent Covid-related protests in multiple cities suggest that volatility will persist in the near term. The big question is whether these protests will hasten the opening of China.

It’s worth revisiting why one should invest in Chinese equities in the first place. It’s the journey we set out on with the launch of our pooled multi-manager fund in 2018.

Why invest in China?

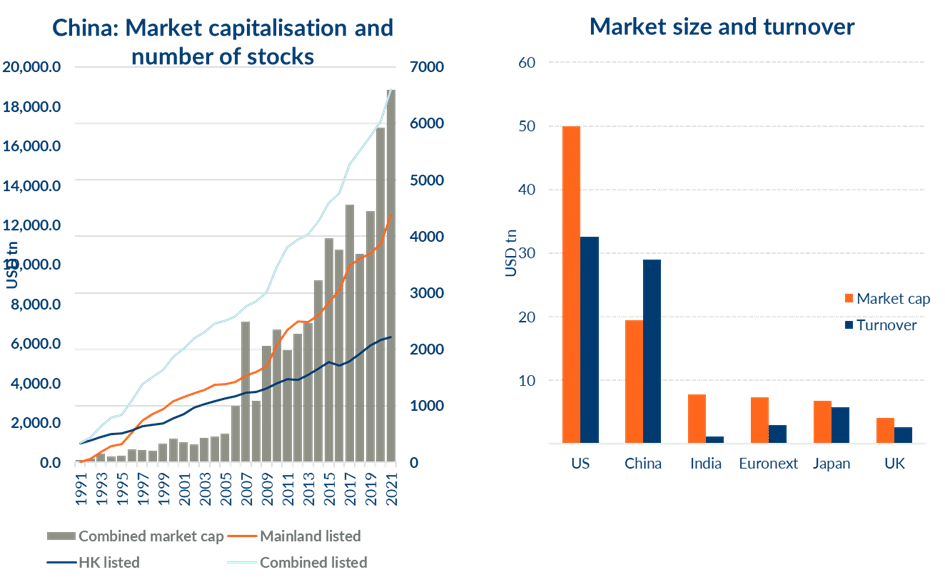

The Chinese equity market is the second-largest stock market in the world after the US. It is larger than Japan and Europe put together. It has thousands of companies, many of which are growing rapidly. Many of them operate in sectors and industries where China is dominant, but they are underrepresented in global market indices. After filtering on ESG, growth and liquidity factors we are left with many hundreds of companies, which is far more than anywhere else in the world, except the US. Currently, these companies are underrepresented by the benchmark indices, such as MSCI.

Source: RisCura research, Hong Kong Stock Exchange, CICC, Wikipedia. Data as of 2021

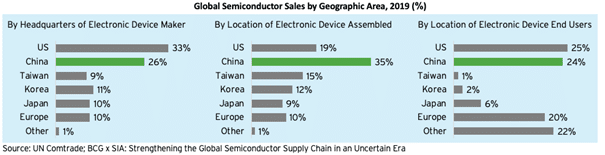

These are companies that are either selling to the world’s largest population or are part of the supply chain of the world’s largest manufacturer of goods. China is responsible for manufacturing about 35% of the world’s electronic devices (as much as 70% for some categories). It is also important to note that most of these are goods that are consumed within China as well as exported. Even if the rest of the world were to stop manufacturing in China, the country would continue to be a major production hub just to meet demand from Chinese consumers.

The charts below show that if the US stopped selling semiconductors to China, this would create a major problem for the global manufacturing of electronic devices.

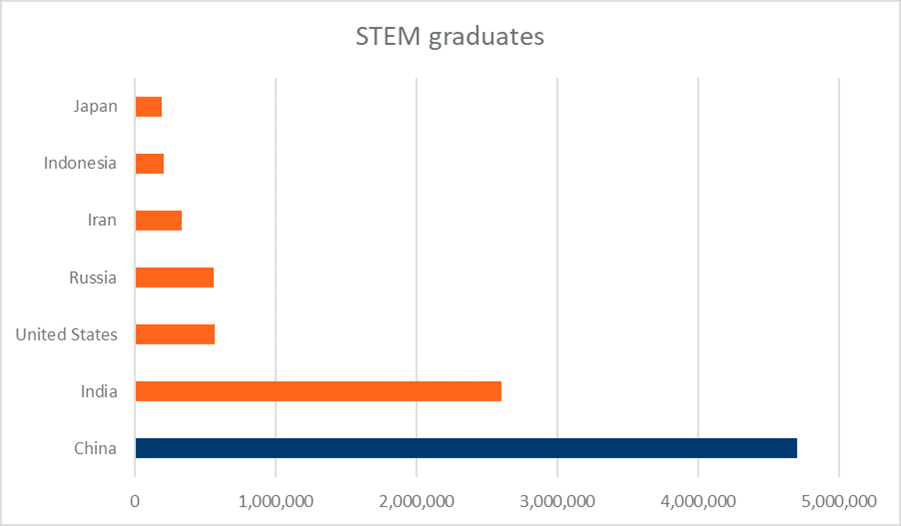

The next point to note is the sheer supply of talent and entrepreneurs that live in the second-largest economy in the world. The chart below shows the number of science, technology, engineering and mathematics (STEM) graduates by country. China has more STEM graduates than India, the US, Russia, Iran, Indonesia and Japan combined.

Source: World Economic Forum, 2016

China is in a unique position by having an organised economy with First World infrastructure, abundant talent, skills and capital (both government and private finance) combined with the largest consumer population and a major manufacturing hub. This is why Chinese companies are so good at large scale engineering. For example, the Tesla Gigafactory Shanghai deal was signed in May 2018, construction was completed in 10 months and the first car was delivered in December 2019. It employs 2 000 people and can produce 750 000 cars annually – significantly more than any facility in the US. That is almost impossible to achieve for most countries.

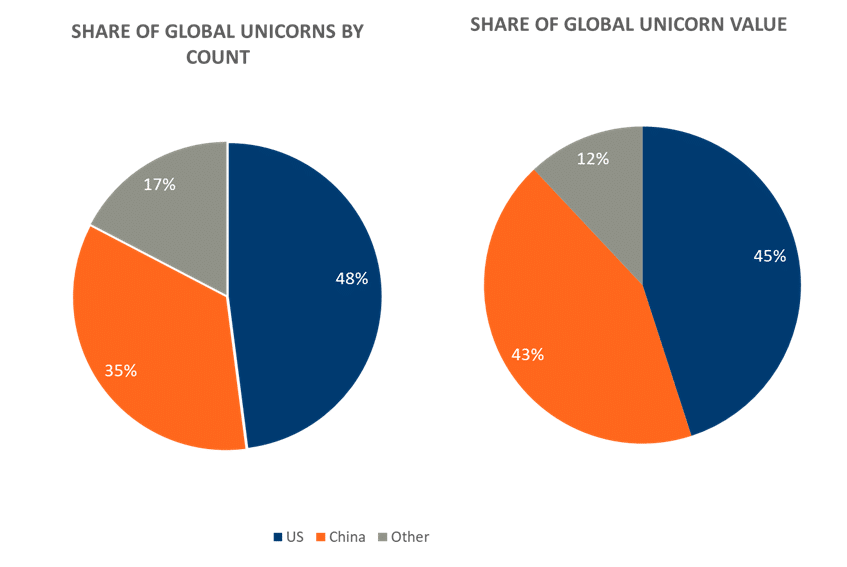

An entrepreneur who has a successful idea doesn’t have to leave China to become the world’s largest – to make it to the proverbial Disneyland. The Chinese population is enough to ensure success. That is why China and the US are the two countries that have a track record of creating multi-billion-dollar companies. It is perhaps no surprise that China has the most unicorns (start-ups that are worth more than USD1bn) in the world after the US.

Source: McKinsey Global Institute, “China’s Digital Economy: A Leading Global Force”

Despite the bumps on the road to Disneyland, we believe the fundamentals have not changed. We believe that China deserves an allocation in global portfolios, but it should be sized accordingly to reflect the risks. If it wasn’t for these risks, it would make sense to have an allocation to China that is significantly greater than that of most developed countries. But risks do exist.

The bumpy road

The last two years have demonstrated almost every reason why an allocation to Chinese equities should be moderate, whether it be on ESG grounds, geopolitical tensions or government interference in the running of the economy. The margin of safety required to invest in Chinese equities has increased as these risks have become apparent.

However, the fear of these risks has led to indiscriminate selling, with crashing valuations of even the best companies. What is so important to note is that many of these companies are among the best in the world at what they do and many of them are either already delivering strong earnings growth or are going to be the beneficiaries of pent-up demand from consumers coming out of Covid lockdowns.

This contrasts with US companies that are still trading at relatively higher valuations and facing earnings uncertainty due to rising inflation and tightening monetary conditions. Nor are these US companies insulated from the geopolitical risks in China: restrictions on their ability to sell or manufacture in China will have significant consequences on their revenues. So, it is odd that their valuations do not reflect this risk while the valuations of Chinese companies clearly do!

Meanwhile, there are companies across emerging markets that are delivering earnings growth but are trading at depressed valuations due to fear. Ultimately prices will reflect fundamentals. Hence, we believe that the recent recovery will continue, although it may not be a smooth ride yet on the way to Disneyland.