Market Commentary: April 2023

Highlights

Global Market Themes:

- Developed markets rise while emerging markets fall; MSCI World up 1.75%, MSCI EM down -1.1%.

- US Federal Reserve raises the Fed Funds rate by 25 basis points (bps).

- UK inflation slows but remains above 10% level; UK financial markets rebound, FTSE 100 up 3.4%.

- ECB inflation above upper band; also raises key rate by 25bps.

- Oil falls well below USD80 per barrel.

SA Market Themes:

- South African inflation rises to 7.1% year on year.

- Interest rates expected to rise again towards end of May.

- South African financial markets bode well from rising commodity prices and a weakening Rand.

- Namibian monetary policy deviates from its South African neighbours, rising only 25bps.

Market View

Global Market Themes

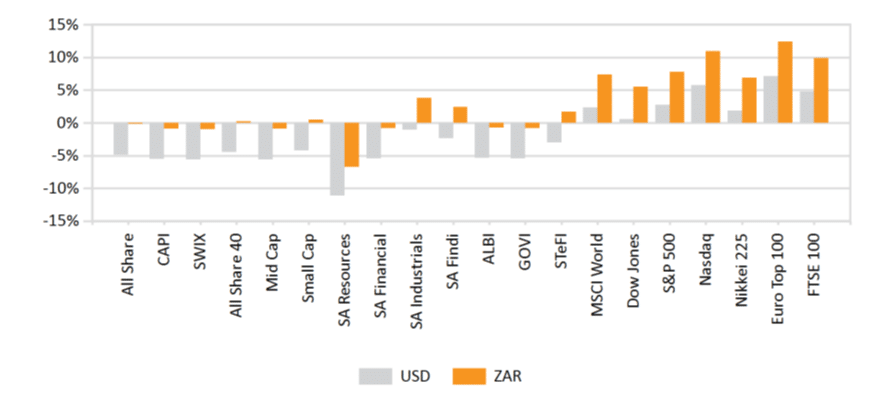

Despite economic data signalling slower growth and persistent inflation, developed markets experienced positive price movement in April with the MSCI World up 1.75%. While inflation globally remains sticky, the downward trend has begun and some of the US Federal Reserve (Fed) policy decision-makers have started to align to adopt a “wait and see” approach to access whether the hikes in May will be restrictive enough to supress inflation. The beginning of May saw Federal Open Market Committee Chair Jerome Powell announce a 25bps increase in the Fed Funds rate. This marks the fastest pace of monetary tightening since the early 1980s. As long as wages remain high and unemployment rates stay low, interest rates are expected to remain higher for longer. The next committee announcement is scheduled for 14 June.

The Conference Board has set the likelihood of a recession in the US within the next 12 months at a staggering 99%. This statistic, along with the institution’s Leading Economic Indicator (LEI) dropping further to -7.8%, suggests that more financial pain is on the horizon which has not been priced in by the markets. The year-to-date performance has seen substantial capital gains on the Nasdaq Composite and S&P500 indices up 19.6% and 9.1%, respectively. US tech companies have rebounded off 2022’s lows, with the likes of Nvidia rising 90%, Meta Platforms up 76% and Apple up 27% year to date.

The UK’s inflation slowed slightly last month but held stubbornly above the 10% level, further fuelling a cost-of-living crisis, despite an aggressive series of interest-rate hikes.

Analysts expect inflation to fall over the course of 2023, as energy prices and electricity costs start to soften. The food component of the UK’s inflation remains a significant contributor at 13.6%, which is down from 15.5% in March. The government has set a target of halving inflation by the end of the year. All the while, the financial markets illustrated some unexpected (but welcomed) optimism in April, with the FTSE 100 Index rising 3.4% after last month’s sell-off. This movement contrasts with the UK Manufacturing (Purchasing Managers’ Index (PMI), which is slightly down to 47.8. The Pound strengthened against the Dollar by 1.84% for the month.

The eurozone experienced an uptick in inflation in April, from 6.9% to 7%, strengthening the case for further interest rate hikes. However, hikes are expected to be of a smaller magnitude than the previous 50bps. Although far above the 2% inflation target, economic data shows signs of improvement. European Central Bank (ECB) lending data reveals the slowest growth of credit for households since 2018. The Euro gained ground relative to the Dollar for the second consecutive month, up 1.6% in April. European financial markets also closed the month in the green with the Stoxx All Europe up 2.5% for April. The ECB mirrored the Fed’s interest rate hike in May, also raising its key rate by 25bps.

China’s economy grew by 4.5% year on year in the first quarter of 2023, signalling that the world’s second-largest economy is on the path to recovery after the end of its strict “zero-Covid” policies.

This growth figure falls slightly short of the 5% growth target set for 2023, but is still ahead of market expectations. China Manufacturing PMI dropped from 51.9 in March to 49.2 at the end of April. The 50-point mark separates expansion from contraction.

Commodities experienced mixed performance in April, with Iron ore and Coal falling 18.6% and 7.3%, respectively. Precious metals closed the month in the green with Platinum and Silver up 8.3% and 4%, respectively. Oil has had a poor 2023 despite renewed demand following the reopening of China and a supply cut from OPEC+. The impact of a possible economic downturn has proven detrimental to the commodity’s price. At the time of writing the price of oil sits at USD72/barrel.

The banking sector’s black swan events during the first quarter did not materialise into a full-blown crisis, but they have left their mark. Banks need to restore the risk/reward balance to attract depositors, placing pressure on banking sector margins. In addition, further compliance requirements will add costs to the banking process. As a result of tougher market conditions, players in the sector will start to consolidate. J.P. Morgan’s recent acquisition of First Republic Bank saw the nation’s largest bank take on USD92 billion additional deposits and a loan book of worth USD173 billion. As part of the deal terms, the Federal Deposit Insurance Corporation agreed to include a loss-sharing provision covering 80% for residential mortgages over seven years and 80% of commercial loans, including real estate for the next five years. The consolidation raised concerns around market concentration in the lending space.

South African Market Themes

South Africa’s consumer price inflation rose to 7.1% year on year in April 2023. This upward pressure came from the continued rise in food inflation which accelerated to 14.4% year on year. Higher inflation supports the case for the South African Reserve Bank (SARB) to raise interest rates. The money market has also become increasingly hawkish since the March Monetary Policy Committee (MPC) meeting and expects rates to increase to 8.0% in May 2023. South Africans continue to feel the pressure from the last nine interest rate hikes, paying 35% more on their home loans compared to early 2021 when the hike cycle started. The prime lending rate currently sits at 11.25%. While we have seen an overall reduction in headline inflation this year, prints remain above the upper band mandate of 6%. In the most recent (March) rate hike, the five-member MPC committee was split three/two in its decision, with three members proposing a 50bps increase, against two suggesting a 25bps increase. The next monetary policy meeting is scheduled for 23 – 25 May.

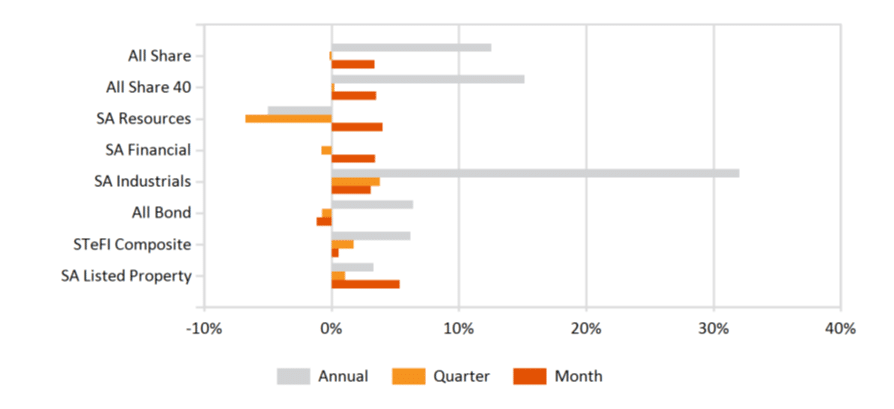

Contrary to emerging market peers, South African local markets had a positive month with all sectors rising more than 3%. The FTSE All Share Index closed the month up 3.4%, while the resources sector made substantial gains, up 4%. Gold and platinum shares were the big winners as the global price of precious metals rose. Gold closed the month at USD1 990, slightly shy of its all-time high of USD2 000. The demand for the safe-haven asset has remained robust while market volatility and risk of imminent economic recession persists. Northam Platinum was up 24% month on month, claiming the top spot for capital gains on the JSE in April. SA Listed property rebounded strongly, recovering all the loses sustained earlier in the year, the Listed Property index was up 5.4% for the month.

The Rand remains under pressure from a volatile global risk sentiment. Domestic factors such as power shortages and political unrest ahead of the elections next year will also weigh negatively on the local currency. The Rand depreciated 3% against the greenback and 4.8% against the Pound. Nominal bond markets declined in April, with the ALBI shedding 1.2%. Inflation-linked bonds closed slightly in the green with the R197 and R202 up 0.5% and 0.24%, respectively. South African Manufacturing PMI improved from 48.1 in March to 49.8 in April, despite loadshedding being firmly entrenched at Stage 6.

The Bank of Namibia deviated from South African monetary policy for the first time this year, raising borrowing costs by a quarter percentage point over concerns that a bigger increase would constrict demand and dampen economic growth.

The monetary policy committee lifted the repurchase rate to 7.25% from 7%. The hike was less than the South African Reserve Bank’s 50 basis-point increase last month. Namibia’s monetary policy often tracks that of neighbouring South Africa because its currency is pegged to the Rand, but the two countries have diverged when their inflation trajectories differ.

In company news, Capitec, which now services one-third of the nation’s bankers, saw a 15% rise in headline earnings from a combination of reduced operating expenditure and increased revenue from its various product streams. Yet its share price did not respond accordingly. Capitec’s share price has declined for the last five consecutive months, dropping 22% since December.

Swiss luxury-goods giant Compagnie Financière Richemont SA is set to open a secondary share listing in South Africa, replacing a depository receipt programme in the country in a bid to reduce complexity and streamline trading. The original structure was set up to comply with South African exchange-control rules that no longer apply, and a new listing would facilitate cross-border trading of “A” shares, as well as reducing complexity for the company, Richemont said.

The Sappi share price declined by 9.3% in April, after the company was fined R8 million for pleading guilty to breaking environmental laws by exceeding the sulphur dioxide emissions limit in KwaZulu-Natal. Sappi has since put out a statement reiterating its commitment to improve its environmental footprint.

Performance

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices