China’s rapid progress in healthcare

The Chinese equity market showed a relatively positive trend in March. The market continued its spring rally during the first half of March, with risk appetite maintained during the "Two Sessions" period. Investments remained focused on policy-driven momentum and emerging industry trends. However, approaching the latter half of the month, the market was affected by the earnings reporting season. In early March, a three-year-old Chinese startup made global headlines with the launch of its first general AI agent, Manus.

Key insights from the report include:

- Several ADRs delivered a strong performance during the month.

- Biotech remains vulnerable to recurring regulatory scrutiny, particularly around drug pricing in the U.S. and China.

- The biotech sector’s long-term fundamentals remain compelling, despite certain pressures.

- Healthcare expenditure as a percentage of GDP is expected to rise globally.

In March, the Chinese equity market showed a relatively positive trend. The market continued its spring rally during the first half of March, with risk appetite maintained during the “Two Sessions” period. Investments remained focused on policy-driven momentum and emerging industry trends. However, approaching the latter half of the month, the market was affected by the earnings reporting season.

Sectors lacking positive earnings support underwent corrections, and the market gradually returned to trading based on economic fundamentals and expectations around annual and first-quarter earnings reports.

The technology sector was active but volatile throughout the month, initially boosted by AI momentum and policy optimism, with gains in semiconductors and AI-related stocks, but later pulled back due to U.S. tech weakness and valuation concerns. Meanwhile, the consumer sector gained traction amid signs of economic recovery and stable earnings from leading companies, supported by pro-consumption policies like vouchers and trade-in programs, which are expected to further drive sector growth.

Macro data continued to signal recovery. The manufacturing PMI held at 50.5 in March, marking a second month of expansion. Foreign trade remained resilient, with January–February exports up 2.3% year-on-year, largely driven by electromechanical products. On the domestic front, retail sales grew 4.9% in March, with big-ticket items like home appliances rebounding 10% thanks to policy support. Fixed asset investment rose 4.8% in the first quarter, as strength in manufacturing investment offset weakness in the property sector.

Several ADRs (U.S. listed Chinese stocks), delivered a strong performance during the month, supported by two key factors.

First, China’s economy continued its steady recovery as the increasingly distant effects of the pandemic subsided. Improved data in sectors like manufacturing and consumer spending strengthened investor confidence in the earnings outlook for Chinese companies, pushing stock prices higher.

Second, the Chinese government implemented a range of pro-growth measures, including more active fiscal policies and a moderately loose monetary stance. These policies improved the business and financing environment, boosted overall market sentiment, and provided solid support for Chinese stocks listed abroad.

In early March, a three-year-old Chinese startup made global headlines with the launch of its first general AI agent, Manus.

Unlike traditional large language models, Manus is designed to operate independently, plan and execute complex tasks, and deliver complete results without human intervention. In benchmark tests for General AI Assistants (GAIA), Manus outperformed OpenAI’s DeepResearch across all three difficulty levels, signalling that Chinese AI is not only catching up but taking the lead in certain areas of AI development. (The demo video is well worth a watch: www.manus.im.)

Following these developments, global brokers, including Goldman Sachs and Morgan Stanley, have raised their target prices for Chinese stocks, citing a potential valuation recovery.

Strong inflows from onshore investors and hedge funds have been observed, while global long-only funds and long-term capital allocators remain underinvested. Combined with low valuations and strong policy stimulus, this suggests that the Chinese equity market may still be in the early stages of a bull run although headwinds from Trump’s tariffs will also need monitoring.

Healthcare in China

Since 2021, the global biotechnology sector has faced one of its sharpest downturns in recent memory. Rising interest rates have been the primary headwind, compounded by a post-COVID reset and a shift in capital toward large-cap technology stocks, which have drawn flows away from other growth sectors. Additionally, biotech remains vulnerable to recurring regulatory scrutiny, particularly around drug pricing in the U.S. and China. Changes at the U.S. Food and Drug Administration are compounding uncertainty for biotech companies looking for a predictable path towards drug approval.

Despite these pressures, the sector’s long-term fundamentals remain compelling. We are arguably entering a golden era of drug innovation, driven by advancements in bioengineering and increasingly, artificial intelligence. Breakthroughs in the treatment of conditions such as Alzheimer’s and obesity underscore the progress being made.

Chinese biotechnology companies are emerging as global leaders, innovating alongside their American counterparts.

An ageing world

As most major economies, including China, face rapidly ageing populations, the incidence of serious illnesses is set to rise significantly. It is estimated that:

- 1 out of 5 aged over 75 have cancer

- 1 out of 4 aged over 75 have heart disease

- 1 out of 4 over 85 have Alzheimer’s

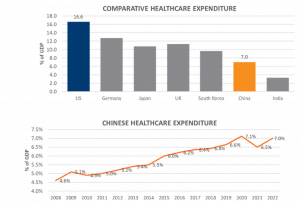

As populations age, the prevalence of chronic and age-related illnesses rises, an inevitable shift toward an ‘older and sicker’ demographic. As a result, healthcare expenditure as a percentage of GDP is expected to rise globally. In China, where healthcare spending remains comparatively low relative to other major economies, this upward trajectory is likely to be magnified.

Source: WHO, National Health Commission China

Fortunately, significant medical breakthroughs are emerging to address some of the most pressing health challenges, from weight loss drugs targeting obesity to innovative treatments for Alzheimer’s. Obesity, a major contributor to various illnesses such as heart disease, underscores the importance of these advancements. Notably, much of this drug innovation is being driven by smaller, more specialised biotechnology firms.

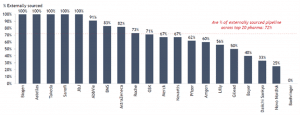

The following chart illustrates that the leading global pharmaceutical companies are increasingly sourcing the majority of their drugs externally, rather than relying on in-house development.

Source: Lilly Asia Ventures

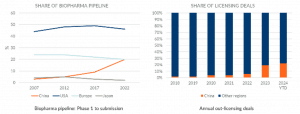

Many of these specialised biotechnology firms are based in the U.S. but China has now surpassed both Europe and Japan to become the second-largest hub for drug innovation.

Seven of the top twenty licensing deals awarded in 2023 were to Chinese biotechnology companies. The charts below illustrate the rapid growth of China in this specialist field although still well behind the USA.

Source: Lilly Asia Ventures

China’s investment in research and development is growing at twice the pace of the global average, with some biotechnology companies allocating up to 30% of their revenues to R&D.

The country’s scale gives it a unique advantage, offering a complete ecosystem that spans raw materials, end-to-end supply chains, scientific expertise, and one of the world’s largest healthcare markets. Much like in manufacturing, global pharmaceutical firms are increasingly leveraging this ecosystem.

Earlier this month, AstraZeneca announced plans for a $2.5 billion R&D hub in Beijing, while cancelling a smaller project in the UK – underscoring China’s strategic importance. Notably, this decision comes despite ongoing regulatory scrutiny of AstraZeneca’s oncology operations in China, including allegations of illegal sales practices and the detention of local staff.

AstraZeneca is not alone in its commitment to Chinese R&D. Global pharmaceutical leaders such as Pfizer, Eli Lilly, and Genmab have all reaffirmed their investment and research efforts in China, recognising the country’s growing strategic importance in the biotech ecosystem.

Fortunately, healthcare is also too sensitive of an area for geopolitics. It is very hard to restrict progress in either more cures to illnesses or reduce the price of healthcare no matter where the drugs come from.

So far, the role of Chinese companies in global healthcare, including in the U.S. continues to rise despite trade tensions in almost all other areas.

However, the sector is still not completely immune to all adversities. The proposed Biosecure Act in the U.S. prohibits entities that receive federal funds from using biotechnology that is from a company associated with a U.S. foreign adversary. Should it pass, it will impact the Chinese Contract Development and Manufacturing Organization companies. However, even this legislation has now been pending for many years, and it has not been as easy to pass partially due to the adverse effects to the sector in the U.S.

Akeso is an interesting example where its share price has increased by 6 times from its lows in 2022. More significantly, it has delivered returns during a period when the broader Chinese economy and equity markets have faced headwinds. The company’s breakthrough in lung cancer treatment by successfully combining drug types to reduce toxicity, has driven investor confidence. Akeso is now co-developing Ivonescimab with Summit Therapeutics, whose share price has surged 19-fold over the same period, partially due to this drug which is still under development.

Healthcare is a sector that China is increasing its global leadership by the day and is providing and will continue to provide attractive investment opportunities.

Subscribe to our Monthly China insights report, providing a detailed and insightful analysis of the state of the Chinese equity market.