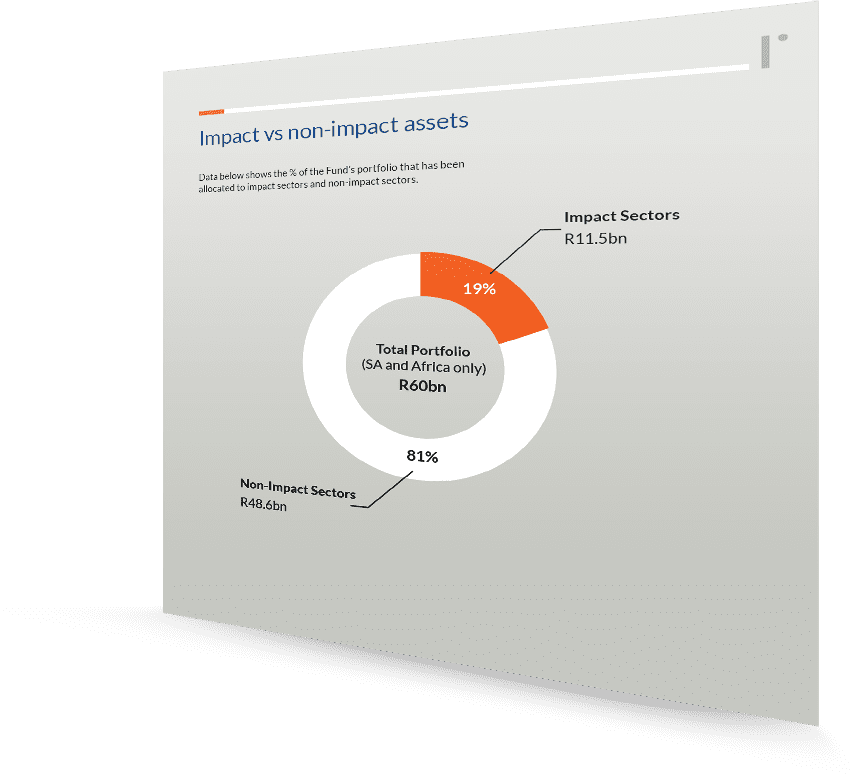

Emerging Markets Offer Unprecedented Opportunities for Investors

Cape Town — In an increasingly global investment landscape, the case for emerging markets is more robust than ever, according to Lars Hagenbuch, a product specialist at RisCura, these regions.…